working capital turnover ratio formula class 12

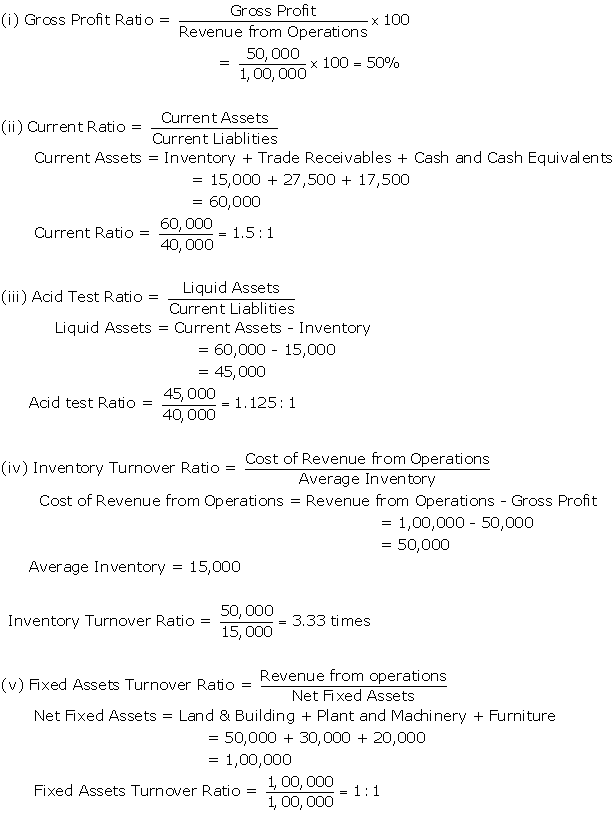

Working capital turnover ratio is an activity ratio that measures dollars of revenue generated per dollar of investment in working capital. Closing creditors and bills payable can be used in the above formula.

Capital Turnover Definition Formula Calculation

Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

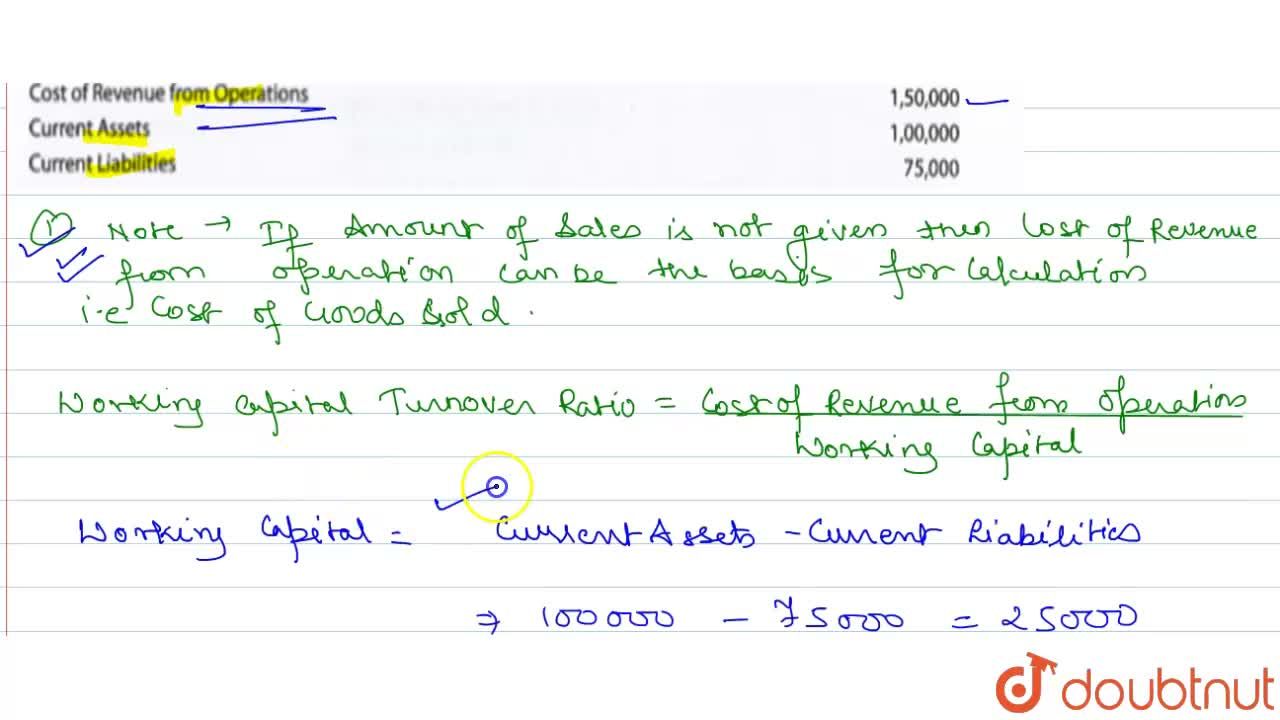

. Working capital is defined as the amount by which current assets exceed current liabilities. To arrive at the average working capital you can sum. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

WC Turnover Ratio Revenue Average Working Capital. Average Working Capital Working Capital on The Beginning of the Period Working Capital on The End of the Period 2. Calculate the Inventory turnover ratio from the following information.

The working capital turnover ratio is thus 12000000 2000000 60. Working Capital Current Assets - Current Liabilities. This means that every dollar of working capital produces.

Working Capital is the excess of Current Assets over Current Liabilities which is expressed as follows. This formula is as follows. It means that the company is utilizing its working capital.

RD Sharma Class 12 Solutions. The average working capital during that period was 2 million. Or Current Assets Working Capital Current Liabilities.

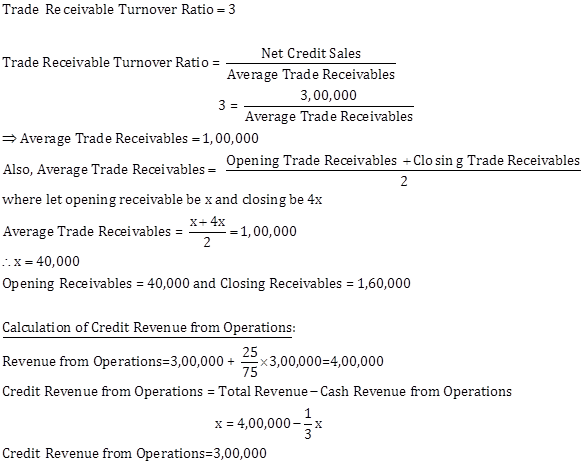

What this means is that Walmart was able to generate Revenue in spite of having negative working capital. Working capital turnover ratio This ratio shows the number of times the working capital has been. Net Credit Sales 18 00000.

Working capital turnover ratio Sale or Costs of Goods Sold Working Capital. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Extending the cash turnover ratio by dividing 365 by the CTR provides the number of days on average that it takes for a company to replenish its cash balance.

Net Working Capital and Revenue from Operations ie Net Sales. Working Note-Net Revenue from Operations Rs. The formula for calculating working capital turnover ratio is.

Trade Payables Turnover Ratio Net Credit Purchases Average Trade Payables. Therefore a high turnover ratio indicates management is being very efficient in using its short. Working Capital Current Assets Current Liabilities.

Working Capital Current Assets Current Liabilities. RD Sharma Class 11 Solutions Free PDF Download. It establishes the relationship between.

Where Net Sales Total Sales Returns Discounts. Calculating Working Capital Turnover Ratio provides a clear indication of how hard you are putting your available capital to work in order to help your company succeed. The formula for calculating working capital turnover ratio is.

Working capital turnover Net annual sales Working capital. Calculation of Working Capital Turnover Ratio-Working Capital Turnover Ratio Net Revenue from operations Working Capital Working Capital Turnover Ratio Rs. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

Or Current Liabilities Current Assets Work ing Capital. Net Working Capital Current Assets excluding Fictitious assets Current liabilities. Ii Working Capital Turnover Ratio.

Liabilities can be ascertained using the given current ratio. Working capital Turnover ratio Net Sales Working Capital 7. Working capital turnover ratio Turnover ratio Class 12.

NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. Sales working capital150000current assets current liabilities 150000145005500-15000 150000500030times iii Return on investment. Working capital turnover ratio interpretation.

Working Capital turnover ratio Accounting Ratio Activity ratio class 12 Accounts video 110class 12 Accountsaccounting ratiosworking capital turnover. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. Also if credit purchases are not given then all purchases are deemed to be on credit.

Jen writes the amounts into the working capital turnover ratio formula which is as follows. Revenue from the operation for the year were RS. The formula to measure the working capital turnover ratio is as follows.

A higher working capital turnover ratio is better. The more sales you bring in per dollar of working capital deployed the better. From the following information calculate the working capital turnover ratio.

Working Capital Turnover Ratio Net Sales Average Working Capital. The Formula for the Working Capital Turnover Ratio is. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times.

What is Financial Modeling Financial modeling is performed in Excel to forecast a. This means that for every 1 spent on the business it is providing net sales of 7. Inventory turnover ratio Ratio Analysis Class 12 Example 15.

Working Capital Turnover Ratio Formula. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. 70000 2 Rs.

Profit before interest and tax capital employed. Salescurrent assets - current liabilities or 1000000500000 - 250000 4. Average Trade Payables Creditors in the beginning Bills payables in the beginning Creditors at the end Bills payables at the end 2.

Capital Turnover Ratio 500000 40000 125 Interpretation It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company. Putting the values in the formula of working capital turnover ratio we get. Working capital can be calculated by subtracting the current assets from the current liabilities like so.

Working Capital Turnover Ratio. This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times.

If a company has a higher level of working capital it shows that the working capital of the business is utilized properly and on the other hand a low working capital suggests that business has too many debtors and the inventory is unused. Working Capital Turnover Ratio 1. For example if a company reports a cash turnover ratio of 2 the days it takes for cash replenishment would be 365 2 183.

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Ncert Solutions For Class 12 Commerce Accountancy Cbse Chapter 5 Accounting Ratios Topperlearning

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

T S Grewal Solutions For Class 12 Commerce Accountancy Cbse Chapter 4 Accounting Ratios Topperlearning

What Are Activity Ratios Formulas And Examples Tutor S Tips

Compute Working Capital Turnover Ratio If The Cost Of Goods Sold Is Rs 9 60 000 Gross Profit Ratio Is 20 And Excess Of Current Assets Over Current Lia Accountancy Topperlearning Com Cgwwfl99

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Find Net Working Capital Formula

Ts Grewal Solution Class 12 Chapter 4 Accounting Ratios 2020 2021

Accounting Ratios Cbse Notes For Class 12 Accountancy Learn Cbse

Working Capital Turnover Ratio Formula Example And Interpretation

Calcualte Working Capital Turnover Ratio Form The Following Rs Cost Of Revenue Form Opertions 150000 Current Assets 100000 Current Liabilites 75000

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios